s corp dividend tax calculator

Asking the IRS to consider your LLC as an S Corp for tax purposes is very simple. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local income taxes.

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

77951 - 500 77951 100 3586.

. Selecting the value will change the page content. For specific tax advice we recommend you speak with a qualified tax professional. A Dividend Aristocrat is a company thats a part of the SP 500 that has increased its dividends for at least 25 consecutive years.

Dividend Aristocrats must meet and maintain rigid standards including membership in the SP 500 and a history of consistently increasing dividend payments for at least 25 years in a row. Stocks Ex-Dividend Stocks Income Generator Foreign Dividend Stocks UpgradesDowngrades Dividend Portfolios Returns Calculator Dividend History Data My. Once you have filed and verified your income tax return then the next step is to wait for the tax department to process it and send you an intimation notice under section 1431 regarding the same.

It is important to receive the intimation notice from the tax department to ensure that the income details and calculations mentioned by you in your ITR matches with the. Yes dividends earned on stocks or mutual funds are taxable for the year in which the dividend is paid out even if you reinvest your earnings like through a DRIP. When calculating your return on investment use our after-tax rate of return calculator to accurately determine your return on investments.

Further if an investors dividend income exceeds Rs. Tax liability is less than foreign taxes paid the maximum credit you can claim will be the foreign liability. If you choose to form an S Corp there are more stringent rules and regulations you will have to.

TFSA contribution room calculator. NAV returns assume the reinvestment of all dividend and capital gain distributions at NAV when paid. The after-tax average annual total returns are based on the 37 tax bracket and include the 38 tax on net investment income.

The Fund has adopted a policy to pay common shareholders a stable monthly distribution and may pay distributions consisting of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends capital gains distributions and non-dividend distributions also known as return of capital. PBRs dividend yield history payout ratio proprietary DARS rating much more. The tax credit amount that can be claimed depends on the amount of foreign tax due and US.

If the current market price of the stocks of ABC corp. - 575 PRF PERPETUAL USD 1000 120 000 0000 Central Petroleum Limited. So if your foreign taxes due are 400.

5000 in a financial year the fund house also deducts a TDS of 10 before distributing the dividend. Refers to the average yield of all stocks listed in HK which have dividend paid in the past year. You can input Capital Gain on Shares Dividend Income TDS deducted by others etc.

Separate sheet for each Source of Income. An S corporation S corp is a tax status under Subchapter S of the IRS tax code that you can elect for your limited liability company or corporation. Equivalent to 39 of all stocks listed in HK.

Returns are based on the prior-day closing NAV value at 4 pm. Dividends are added to the income of the investors and taxed according to their respective tax slabs. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

After-tax returns are not relevant to investors holding shares through tax-deferred programs such as IRA 401k plans. Self-Employed defined as a return with a Schedule CC-EZ tax form. The calculator will use the Benjamin Graham intrinsic value formula to calculate the intrinsic value per share of the stock.

Mutual funds are subject to risks and fluctuate in value. 1017 stocks have paid dividend in the past year. Its Norfolk Southern Railway subsidiary operates 19500 route miles in 22 states and the District of Columbia serves every major container port in the eastern United States and provides efficient connections to other rail carriers.

Indicated dividend yield GRADE. Americas 1 tax preparation provider. It is calculated by taking into account a companys assets.

S corp status also allows business owners to be treated as employees of the business for tax purposes which can result in tax savings on distributions and based on a reasonable salary. For tax credits investors must fill out Form 1116 which can get complicated. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Provision for Automatic calculation of deduction us 80 GG towards Rent Payment when HRA is not received. The owners salary pays employment taxes and income tax while. 1 online tax filing solution for self-employed.

Dividend Kings vs. Incfile will take care of filling in the paperwork form 2553 and file it with the IRS on your behalf. The tax rate on dividend income varies depending on whether dividends are ordinary or qualified.

Is 500 the companys shares are undervalued by. No tax is to be paid as long as you continue to hold the units. Norfolk Southern operates the most extensive intermodal.

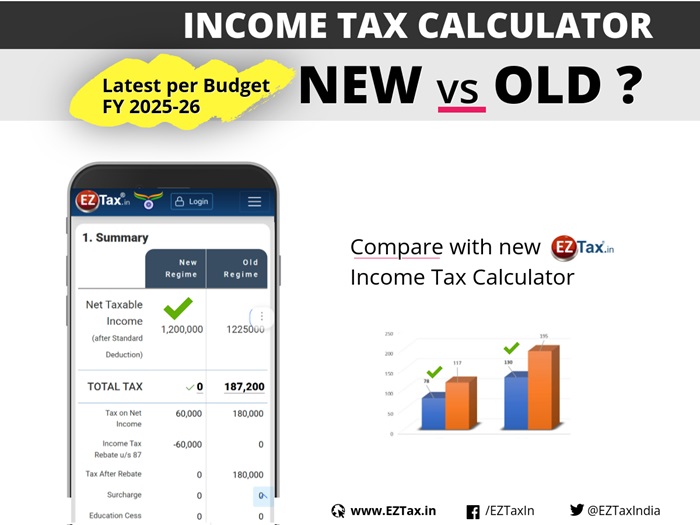

Calculate Taxable Income Tax etc for Old Regime. Its simpler and easier to form an LLC than an S Corporation. The S corp income passes through to the owners individual tax return as salary and distributions.

ProShares based on the SP Technology Dividend Aristocrats Index are not sponsored endorsed sold or promoted by SP Dow Jones Indices LLC. Norfolk Southern Corporation is one of the nations premier transportation companies. Canadas best dividend stocks 2022.

Dividend Tax Calculator 2020 21 Tax Year It Contracting

Effective Tax Rate Formula Calculator Excel Template

Dividend Tax Calculator 2022 23

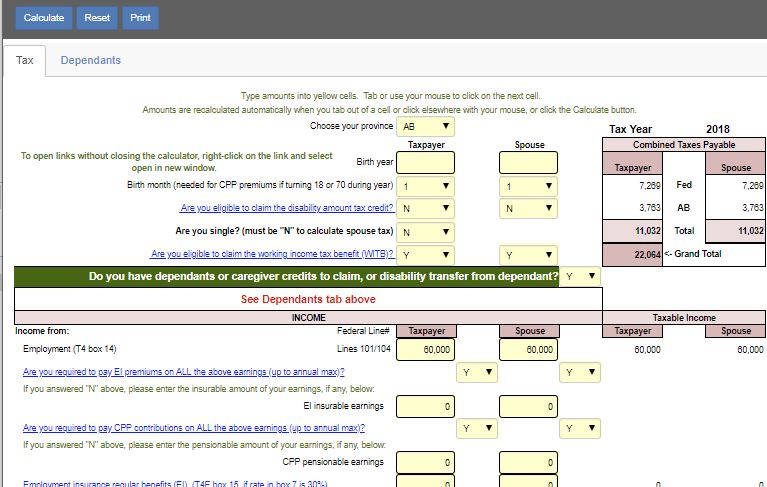

Taxtips Ca 2018 Canadian Income Tax And Rrsp Savings Calculator

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Dividend Tax Calculator Taxscouts

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

What Is A C Corporation What You Need To Know About C Corps Gusto

Dividend Tax How To Calculate Dividend Tax In Uk For 2020 21 Dns Accountants

Dividend Tax Calculator Taxscouts

S Corp Vs Llc Difference Between Llc And S Corp Truic

How Much Tax Do You Pay On Dividends Jf Financial

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Back To Basis Basis Schedule Of S Corporation

Salary Or Dividends Tax Calculations Money Donut

S Corp Vs Llc Difference Between Llc And S Corp Truic

Crypto Staking Taxes Ultimate Guide Koinly